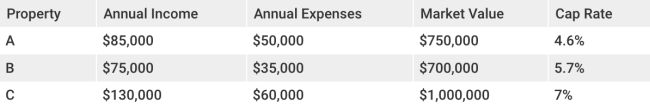

pro forma cap rate

A caprate is only a snapshot from the present. The cap rate takes current income and costs. However, the formula does not take into account any new renovations or marketing changes. These changes can lead to a caprate that is higher or lower depending on the length of the investment term.