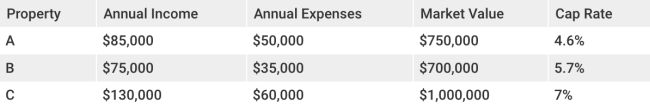

what is good cap rate for rental property

The above cap rate calculation assumes that you receive full rent each month. This means that the property is 100% occupied for at least one year. For a single-family home, 100% occupancy is possible but less so for multiunit buildings with higher turnover. When calculating your cap rate, it's important to take into account a lower than 100% occupancy rate. Here's how: