what is a good cap rate in ontario

There are many regional variations but generally speaking, assets with lower capitalization rates like 4-5% would be classified as a class A or B asset.

Before we get into the discussion of what makes a good rate, let's first review how this metric is calculated!

There are regional variations in cap rates. For a property in NYC, a cap rate of 6% is different than for one in rural areas. A good rule of thumb for real estate investors is that cap rate compression occurs in higher-populated cities. They also have lower average capitalization rates.

There are many regional variations but generally speaking, assets with lower capitalization rates like 4-5% would be classified as a class A or B asset.

Let's sum it up: What is a good multifamily cap rate? It is not possible to find a single "good cap rate real property" that can answer this question. There are many factors that influence whether or not a caprate is reasonable, such as your risk appetite and where you live.

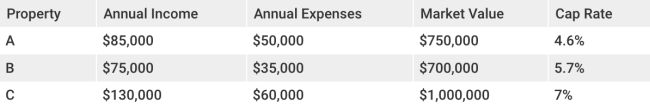

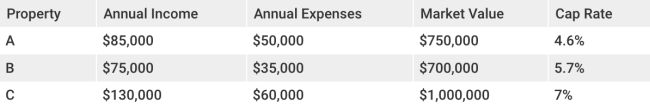

This metric is fairly easy to calculate. To calculate the cap rate, divide the asset's net operational income (NOI), by its purchase price.

Investors need to know what a good caprate in real estate is. To go further, what is the best cap rate for multifamily properties in real estate? These are five facts you should know about the cap rates so that you can decide if your potential investment is worthwhile.

Cap rates are only snapshots of the future. Remember that the cap rate is based on current income and expenses. However, it does not account for new renovations, changes in management, marketing differences, etc. As the investment term progresses, these factors can cause a cap rate to rise or fall.