apartment market value

Cap rates are expressed in percentages and are returns for a single point. They can be used to assess an investment property or to compare properties.

This same cap rate formula can be used to estimate the building's value based on its NOI. If you know that the property generates $500,000 in NOI, and that the appropriate cap rate (i.e. unlevered return) is 5% for a comparable project in the market, then you can divide $500,000 by 5 to get a $10 million value. The same project could be worth only $8.3 million if the market cap rate is 6%. This illustrates how changing return expectations in the market (in this instance, the cap rate), can cause implied real property values to fluctuate as discussed further below.

Many advisors will tell investors that a higher cap rate is better. A good cap rate should be between 5%-10%. This is partly true. An investor should choose a property with a higher caprate to get a better yield. Cap rates don't necessarily reflect all factors. When deciding whether to purchase a property, consider the investor's risk appetite, property location, property condition and ability to grow NOI. There are many other investment-specific factors. Low cap rates are an option for risk-averse investors.

Cap rates are expressed in percentages and are returns for a single point. They can be used to assess an investment property or to compare properties.

Cap rates can be used to determine which investment is more risky or safer. A lower cap rate generally means that it is safer or less risky to invest, while a higher rate can mean more risk.

Cap rates can often be compared with a coupon on a bond because they allow you to express payment in a percentage of an asset's value.

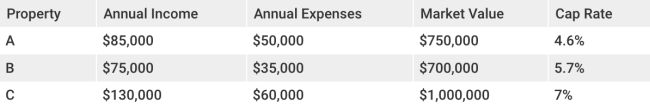

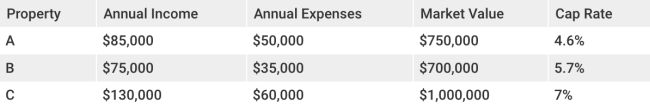

A cap rate can be calculated by simply dividing the annual NOI by the market value. A property worth $10,000,000 and generating $500,000 in NOI would have an annual cap rate of 5%.

Cap rates do not remain static. Cap rates can fluctuate depending on the NOI or the value of the building. This can be due to market conditions or investor improvements.