what is a good cap rate for multifamily

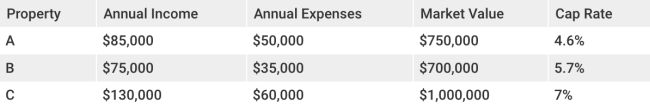

The "caprate" that you should buy depends on where you live and what return you need to make your investment worthwhile. This means you will need to evaluate your tolerance for risk. For example, professionals buying commercial properties might opt for a 4% cap in high-demand areas that are less risky, but may prefer a 10% cap in low-demand areas. It is reasonable to expect to earn 4% to 10% annually for your investment property.