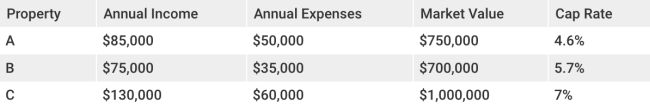

cap rate formula real estate

Asset Class: There are three classes for each property type. These "classes" denote the quality of finishes, the strength and number of tenants, and directly impact the rents that the property can charge. A property of "Class A" is considered the most desirable asset class. It commands the highest rents, and has the highest quality tenants. This is based on creditworthiness and balance sheets. The middle-of-the pack property, a "Class B", receives average rents and has average quality tenants. A "Class C" property, which is the lowest quality property, receives the lowest rents. It also has tenants with poor creditworthiness and receives the lowest rents. The lowest cap rates for Class A properties are the highest and most valuable, while Class C properties have high cap rates but low values. Class B properties have cap rate and values that range between Class A and C. Cap rates also reflect the perceived risk an asset faces. When evaluating whether a cap rate "good", it is important to understand the asset's class and quality in order to determine if it is comparable to other assets in the relevant comparative set.