Breaking Down the Latest Tech Industry Mergers and Acquisitions

Introduction

The tech industry is constantly evolving, with new companies emerging and existing ones seeking ways to stay ahead of the competition. One common strategy employed by tech companies to expand their reach and capabilities is through mergers and acquisitions (M&A). These deals can have a significant impact on the industry landscape, shaping the future of technology and innovation.

1. Company A Acquires Company B: A Strategic Move

One of the most recent mergers in the tech industry involves Company A acquiring Company B. This strategic move aims to combine the strengths of both companies and create a more robust entity. Company A’s expertise in software development complements Company B’s hardware manufacturing capabilities, resulting in a comprehensive product offering.

1.1 Synergies and Benefits

The merger between Company A and Company B brings several synergies and benefits. By integrating their operations, the companies can streamline their supply chain, reduce costs, and improve overall efficiency. Additionally, the merger allows for the development of innovative products that leverage the combined expertise of both companies.

2. The Rise of Big Tech: Acquisition of Startups

Big tech companies have been actively acquiring startups to fuel their growth and stay ahead of the competition. These acquisitions provide them with access to cutting-edge technologies, talented teams, and new markets. For example, Company C recently acquired a promising AI startup, enabling them to enhance their machine learning capabilities and expand into new industries.

2.1 Fostering Innovation

Acquiring startups not only benefits big tech companies but also fosters innovation in the industry. By providing startups with the necessary resources and support, these acquisitions enable them to scale their operations and bring their groundbreaking ideas to market. This collaboration between established companies and startups drives technological advancements and pushes the boundaries of what is possible.

3. The Impact on Competition

Mergers and acquisitions in the tech industry can significantly impact competition. When two major players merge, it can lead to a consolidation of power, potentially reducing competition in the market. This consolidation may result in higher prices for consumers and limited choices. Regulatory bodies closely monitor such mergers to ensure fair competition and protect consumer interests.

Summary

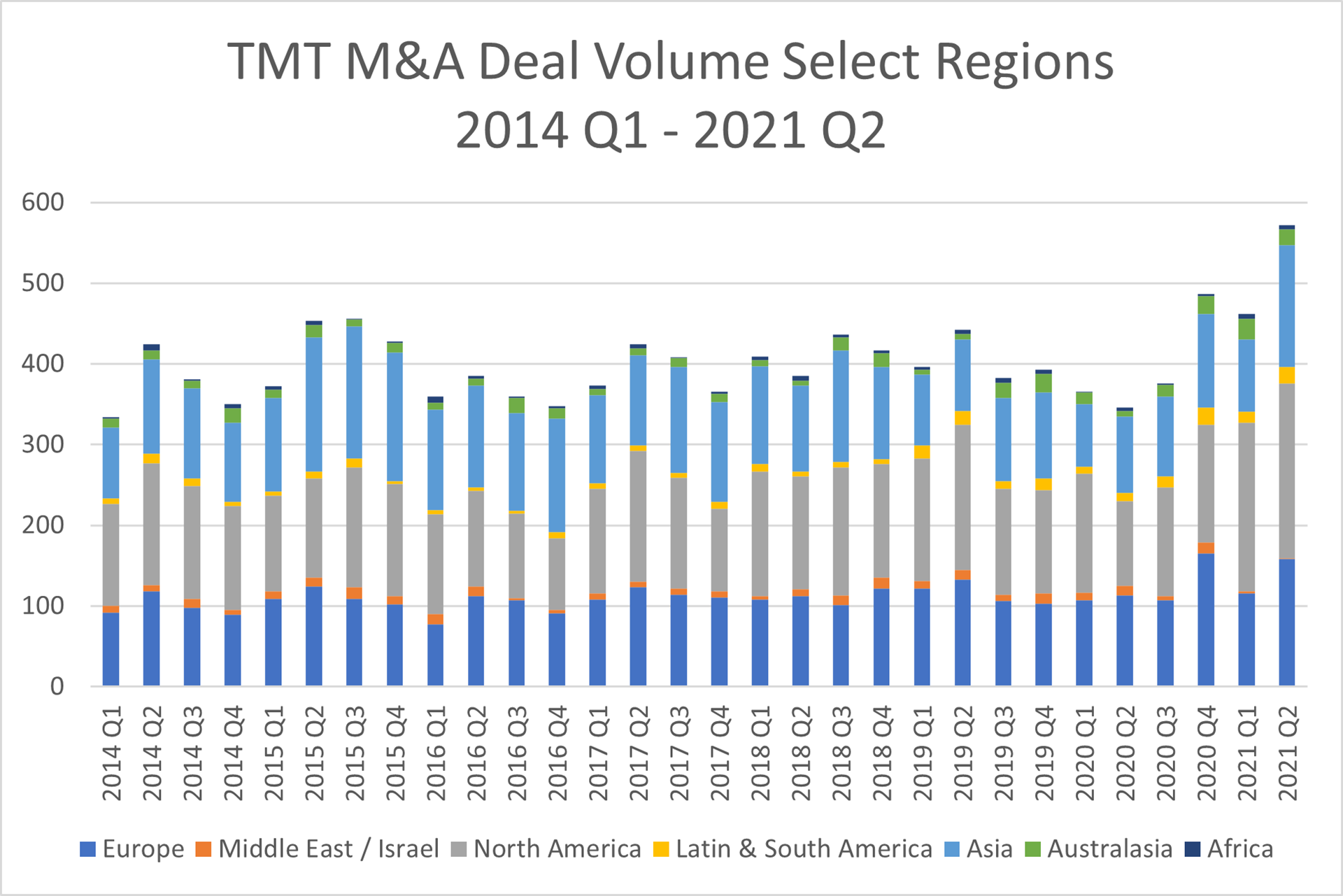

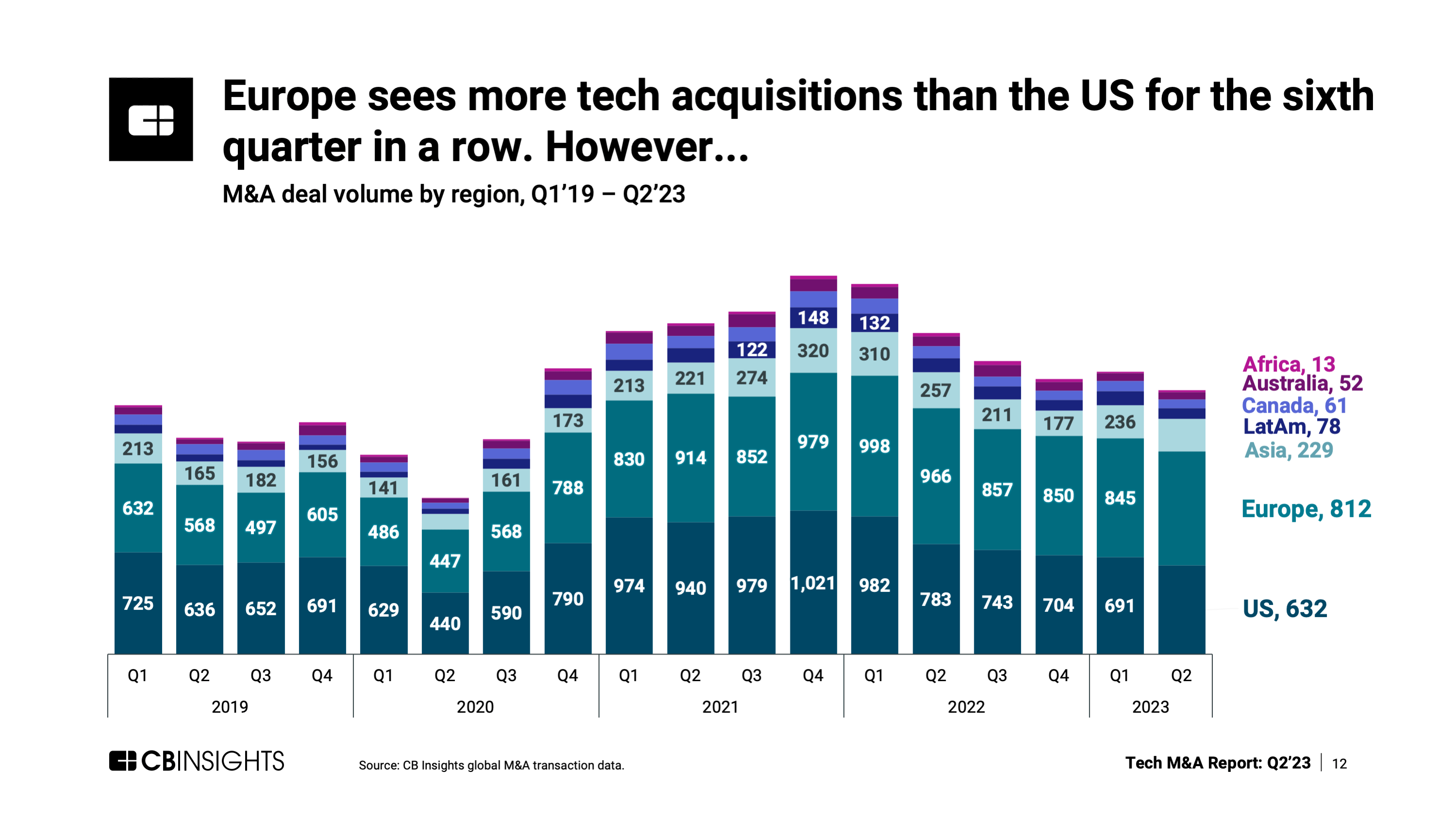

In this blog post, we will delve into the latest mergers and acquisitions within the tech industry, analyzing the motivations behind these deals and their potential implications. We will explore how these strategic moves can lead to increased market share, improved product offerings, and enhanced technological capabilities for the companies involved.

By examining recent M&A activities, we aim to provide insights into the trends and patterns shaping the tech industry. We will discuss the key players, the sectors being targeted, and the driving forces behind these deals. Additionally, we will highlight some notable examples of successful mergers and acquisitions that have reshaped the tech landscape in recent years.

Whether you are a tech enthusiast, an investor, or simply curious about the latest industry developments, this blog post will offer valuable ins pop over here ights into the world of tech M&A. Stay tuned as we break down the latest deals and explore the potential impact on the future of technology.

- Q: What is a merger?

- A: A merger is a combination of two or more companies to form a single entity, typically with the goal of increasing market share or gaining a competitive advantage.

- Q: What is an acquisition?

- A: An acquisition is when one company purchases another company, either through a stock purchase or asset acquisition, to gain control over its operations and assets.

- Q: Why do companies merge or acquire other companies?

- A: Companies merge or acquire other companies to expand their market presence, diversify their product offerings, gain access to new technologies or talent, or achieve cost synergies.

- Q: How do mergers and acquisitions impact the tech industry?

- A: Mergers and acquisitions in the tech industry can lead to increased competition, innovation, and consolidation of market power. They can also result in the integration of complementary technologies and the formation of stronger industry players.

- Q: What are some recent examples of tech industry mergers and acquisitions?

- A: Some recent examples include the acquisition of GitHub by Microsoft, the merger of T-Mobile and Sprint, and the acquisition of Red Hat by IBM.

- Q: How do mergers and acquisitions affect employees of the companies involved?

- A: Mergers and acquisitions can lead to job redundancies and restructuring as companies streamline operations. However, they can also create new opportunities for employees, such as access to a larger talent pool or the chance to work on more innovative projects.

- Q: What should investors consider when evaluating the impact of mergers and acquisitions?

- A: Investors should consider factors such as the strategic rationale behind the deal, the potential for synergies, the financial health of the companies involved, and the regulatory environment in which the deal is taking place.