Unlock the Power of Comprehensive Estate Planning

What is the Key to Protecting Your Family's Future? Unlock the Power of Comprehensive Estate Planning! When it comes to safeguarding the future of your cherished family, there isn't a one-size-fits-all solution. However, delving into the realm of comprehensive estate planning might just hold that key you’re searching for! It's not merely about penning down a last will – though undeniably significant – it encompasses much more than that. Ah, estate planning ; it's a multifaceted puzzle requiring meticulous attention (and sometimes patience) to piece together. By encompassing all aspects – from wills and trusts to healthcare directives and power of attorney assignments – it forms an armor around your loved ones' tomorrow. You'd be forgiven for thinking it's a task reserved for those with vast wealth, but in reality? It’s essential regardless of economic standing. Now, let us consider the influence of these legal devices! A trust can provide financial shelter for your children or grandchildren, ensuring their needs get met even when you cannot oversee them directly. And think about this: Who would make decisions on your behalf if you weren’t able? That’s where a durable power of attorney steps

The Importance of Estate Planning: Understanding Wills and Trusts

Estate planning, an oft-neglected aspect of life's journey, holds paramount significance for individuals aiming to safeguard their assets and ensure the well-being of loved ones after they've departed this world. It's a common misapprehension that estate planning is only pertinent for the affluent; however, this couldn't be further from the truth! Regardless of your wealth's magnitude (or lack thereof), designating clear instructions through wills and trusts can prevent unnecessary strife amongst surviving family members. Wills serve as fundamental documents in estate planning. Essentially, a will provides explicit directives on how one desires their possessions distributed upon passing away. Without such a document, state laws dictate asset division - potentially leading to unintended heirs receiving portions of your legacy. Moreover, parents with minor children should utilize wills to appoint guardianship preferences, thereby avoiding state interference in their offspring's future care. Transitioning into another component: trusts are equally vital yet frequently misunderstood elements within estate planning. Unlike wills (which become public records once probated), trusts offer privacy and can manage assets before and after one's demise. They come in various forms – testamentary trusts created by a will or living trusts established during one’s lifetime

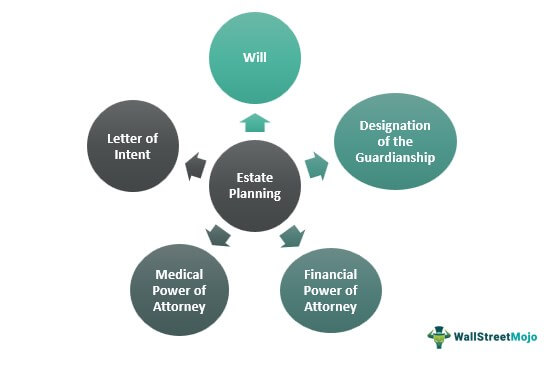

Documents included in an estate plan

Even if you can’t afford a comprehensive estate plan, you can start with a simple, affordable plan such as a will, trust, power of attorney, and term life insurance with plans to reassess the platform later as your financial situation changes. An experienced estate planning lawyer can help you plan your estate; they will look into your financial situation, family needs and advise on a suitable plan. They will also help with the preparation of documents to protect your assets against taxes and lawsuits. These include titles, last will and testament, power of attorney, advance directives, and living will and trusts. All estate plans should include documents that cover three main areas: asset transfer, medical needs and financial decisions, says holly geerdes, an estate planning attorney with estate law center usa. Your advisor, working with a bank of america 1 trust professional, may be able to help. They can provide an overview of the current federal gift and estate tax, identify if you live or own property in a state that may impose wealth transfer taxes and identify strategies that you may want to discuss with your estate planning attorney or tax advisor. They can also explain how

Is Estate Planning Only for the Wealthy?

When tax laws change, review your portfolio to see how it might be affected. Arming yourself with an effective tax strategy can help you avoid costly mistakes that could eat into your estate. Your strategy could include: planning for state estate taxes. In addition to the federal estate tax, several states levy their own estate and inheritance taxes. For instance, 12 states and the district of columbia have a state estate tax, and 6 states have an inheritance tax. As of 2024, maryland is the only state that levies both. While estate taxes are only collected from a small percentage of extremely wealthy families (assets that exceed $13. A trust is a legal estate planning document that involves three parties: a trustor, a trustee and a beneficiary (or beneficiaries). It’s set up by a trustor to give a trustee authority to hold and manage assets on behalf of your named beneficiary or beneficiaries. There are several types of trusts, and which one is right for you will depend on the size of your estate, your goals and the legacy you want to leave. Importance to estate planning: despite what people once thought, trusts are not just for the very wealthy. The truth is, a trust

Using Life Insurance in Estate Planning

A complete california estate plan is a highly customized set of documents which generally includes a living trust, a pour-over will, durable powers of attorney for property and healthcare, a “hipaa” authorization, a living will/advance healthcare directive, deeds to your properties, beneficiary designations on life insurance, annuities, iras, 401(k)s, guardian nominations for your minor children and incapacitated dependents, and perhaps more. All of these documents must be signed and carefully archived so they can be found when you die or become incapacitated. Some of these will be standard california estate planning forms, but most will be specially drafted for your circumstances. Write a will if you don’t already have one. There are even ways to create a will online. A handwritten will (called a holographic will) may not be enough or valid in your state. Ensure you have enough life insurance. If your next question is " how much life insurance do i need ?" it depends on factors such as whether you're married or if your current lifestyle requires dual incomes. Life insurance is especially important for those who have dependent children. Name a guardian for your children — and a backup guardian, just in case — when

What Is Estate Planning?

Many people take out life insurance as part of estate planning to provide a financial safety net your family can use to pay for your funeral, to meet mortgage repayments or to protect your interests in a business partnership. You may choose to hold this cover in your super fund. Alternatively, it can be held outside super, in which case your beneficiaries may receive a lump sum from the policy after your death. It’s important that you keep your life insurance policies beneficiaries are up to date and listed correctly. At oracle, our team of trusted insurance advisors hold over 30 years’ experience in financial planning for individuals. No one likes to think about their mortality and end-of-life decisions, but estate planning doesn't have to be a dreary experience. In fact, it can be life-affirming as you secure your legacy and ensure your wishes are carried out after you are gone. An estate plan is a collection of documents that govern where your assets go after you pass away. It also includes directives to manage your final years, especially if you cannot make your own decisions. The complete guide to estate planning is designed to help you understand key terms and