Many people take out life insurance as part of estate planning to provide a financial safety net your family can use to pay for your funeral, to meet mortgage repayments or to protect your interests in a business partnership. You may choose to hold this cover in your super fund. Alternatively, it can be held outside super, in which case your beneficiaries may receive a lump sum from the policy after your death. It’s important that you keep your life insurance policies beneficiaries are up to date and listed correctly.

At oracle, our team of trusted insurance advisors hold over 30 years’ experience in financial planning for individuals.

At oracle, our team of trusted insurance advisors hold over 30 years’ experience in financial planning for individuals.

No one likes to think about their mortality and end-of-life decisions, but estate planning doesn't have to be a dreary experience. In fact, it can be life-affirming as you secure your legacy and ensure your wishes are carried out after you are gone. An estate plan is a collection of documents that govern where your assets go after you pass away. It also includes directives to manage your final years, especially if you cannot make your own decisions. The complete guide to estate planning is designed to help you understand key terms and different aspects of estate planning so you can make decisions that are right for you and your family.

Estate planning involves determining how an individual’s assets will be preserved , managed, and distributed after death. It also takes into account the management of an individual’s properties and financial obligations in the event that they become incapacitated. Assets that could make up an estate include houses, vehicles, stocks , art, collectibles, life insurance , pensions, debt, and more. Contrary to what you might think, this isn't a tool meant just for the ultra-wealthy. Anyone can—and should—consider estate planning. There are various reasons why you might begin estate planning, such as preserving family wealth , providing for a surviving spouse and children, funding children's or grandchildren’s education, and leaving your legacy for a charitable cause.

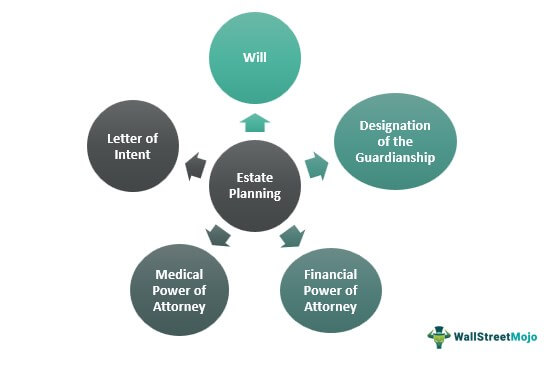

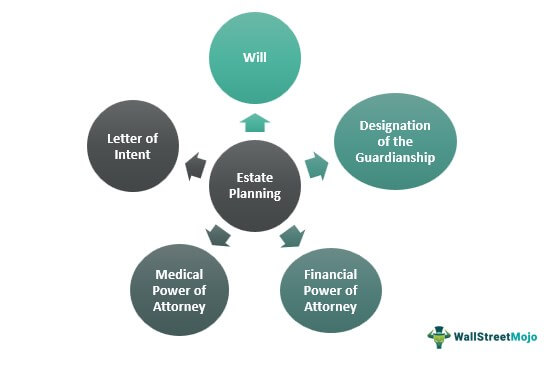

The Estate Planning Process

Organizing your affairs in preparation for the end of your life is an important task, and estate planning is an ongoing process that includes much more than writing a will. This type of planning helps determine who can make decisions on your behalf, who takes care of your dependents, and how to avoid unnecessary taxes and waiting periods.

Estate planning covers any decisions regarding money, property, medical care, dependent care, and other matters that can arise when a person dies. The biggest benefit of estate planning is peace of mind—you’ll know your wishes will be fulfilled for the benefit of your loved ones.

Estate planning covers any decisions regarding money, property, medical care, dependent care, and other matters that can arise when a person dies. The biggest benefit of estate planning is peace of mind—you’ll know your wishes will be fulfilled for the benefit of your loved ones.

Most of us know we need a plan in case something unexpected happens to us, but we may not know what’s involved in the estate planning process. If you aren’t sure what you need to do to create that plan, this article can help you get started. And consulting a financial professional can also help with particular questions and situations that may arise in the estate planning process.

Appointing the Right Executor

For high net worth individuals, estate planning becomes even more critical. Those with substantial assets will have more considerations for intergenerational wealth planning and more opportunities to implement complex estate planning tactics. A few strategies that may exclusively benefit high net worth and ultra-high net worth individuals are estate freezes, family trusts, and charitable foundations. There are also specific life insurance strategies that may be advantageous for high net worth families. Many wealthy individuals will have more complicated estate plans and benefit considerably from appointing a corporate executor. A corporate executor is a professional firm that provides executor services in exchange for a fee.

When that happens (and it is if not when), you probably want to control how those things are given to the people or organizations you care most about. To ensure that your wishes are carried out, you need to provide instructions stating whom you want to receive something of yours, what you want them to receive, and when they are to receive it. You will, of course, want this to happen with the least amount paid in taxes, legal fees, and court costs. That is estate planning—making a plan in advance, naming the people or organizations you want to receive the things you own after you die, and taking steps now to make carrying out your plan as easy as possible later.

Estate planning is the process of arranging who will receive your assets when you die. One goal of estate planning is to make sure your wealth and other assets go to those you intend to receive them — and not to others — with a particular emphasis on minimizing taxes so that your beneficiaries can keep more of your wealth. But good estate planning can also reduce family strife and provide clear end-of-life directives should an individual become incapacitated before ultimately passing away. Unfortunately, many people fail to establish an estate plan, even those who would benefit significantly from it.