5. Get Pre-Approved for a Mortgage

by Admin

Posted on 01-01-2024 01:52 PM

Getting preapproved for a mortgage will help you determine how much you can afford, which will then inform your home search. It’s always smart to shop around for the best rates and terms , so be sure to research a few different lenders during this process.

You can also ask family, friends, your buyer’s agent, and attorneys for mortgage lender recommendations. When choosing a mortgage lender, ask for a detailed cost breakdown, review the terms you are being offered, and compare loan types. According to the us consumer financial protection bureau (cfpb), there are three general categories of mortgage :.

You can also ask family, friends, your buyer’s agent, and attorneys for mortgage lender recommendations. When choosing a mortgage lender, ask for a detailed cost breakdown, review the terms you are being offered, and compare loan types. According to the us consumer financial protection bureau (cfpb), there are three general categories of mortgage :.

8. Consider Additional Expenses

Hawaii, with its active volcanoes, is no stranger to earthquakes. It’s the number three state for earthquakes, with thousands occurring each year. Many tremors are related to volcanic activity and don’t cause major damage.

However, hawaiian homeowners can also experience tectonic and mantle earthquakes, which may cause serious damage. If you want coverage for earthquake damage for your hawaiian home, you’ll need to buy a separate earthquake insurance policy. A standard home insurance policy doesn’t cover earthquakes. Earthquake insurance typically covers:

other structures

additional living expenses

earthquake insurance may have a separate deductible from your home insurance, usually between 10% to 25% of the dwelling’s policy limit.

However, hawaiian homeowners can also experience tectonic and mantle earthquakes, which may cause serious damage. If you want coverage for earthquake damage for your hawaiian home, you’ll need to buy a separate earthquake insurance policy. A standard home insurance policy doesn’t cover earthquakes. Earthquake insurance typically covers:

other structures

additional living expenses

earthquake insurance may have a separate deductible from your home insurance, usually between 10% to 25% of the dwelling’s policy limit.

Question About This Property

Research the housing market in the target area. Once you have information about the general area, focus on the particular property and seller. Look for answers to questions such as: why is the homeowner selling? (if they’re moving because they find the area undesirable, you might want to consider this issue. )how long has the home been on the market? (if it has been on the market for a long time, perhaps there are negative facts about the property that you need to know. )how much did the seller pay for the home compared to the current asking price? (if the seller paid more, find out why.

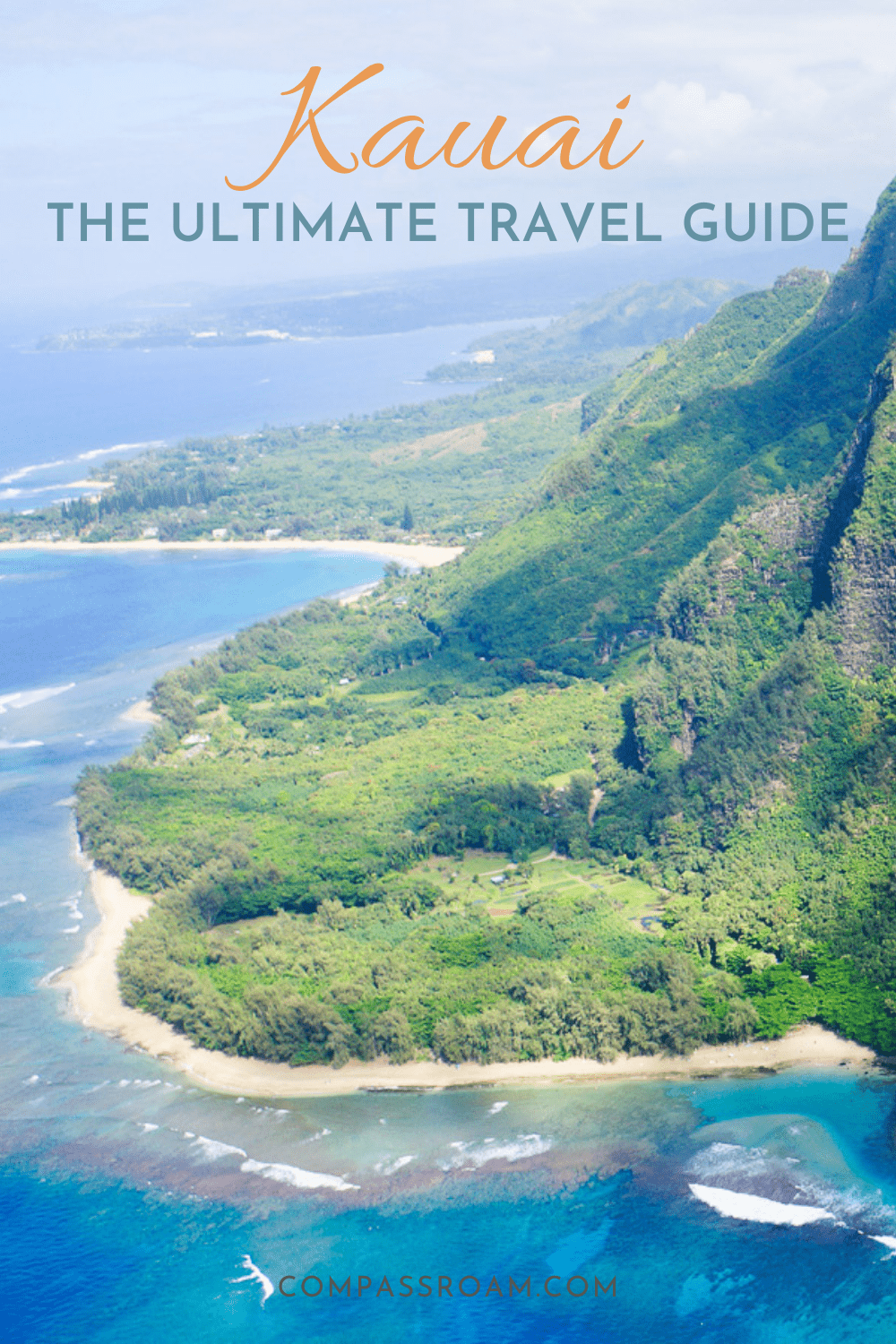

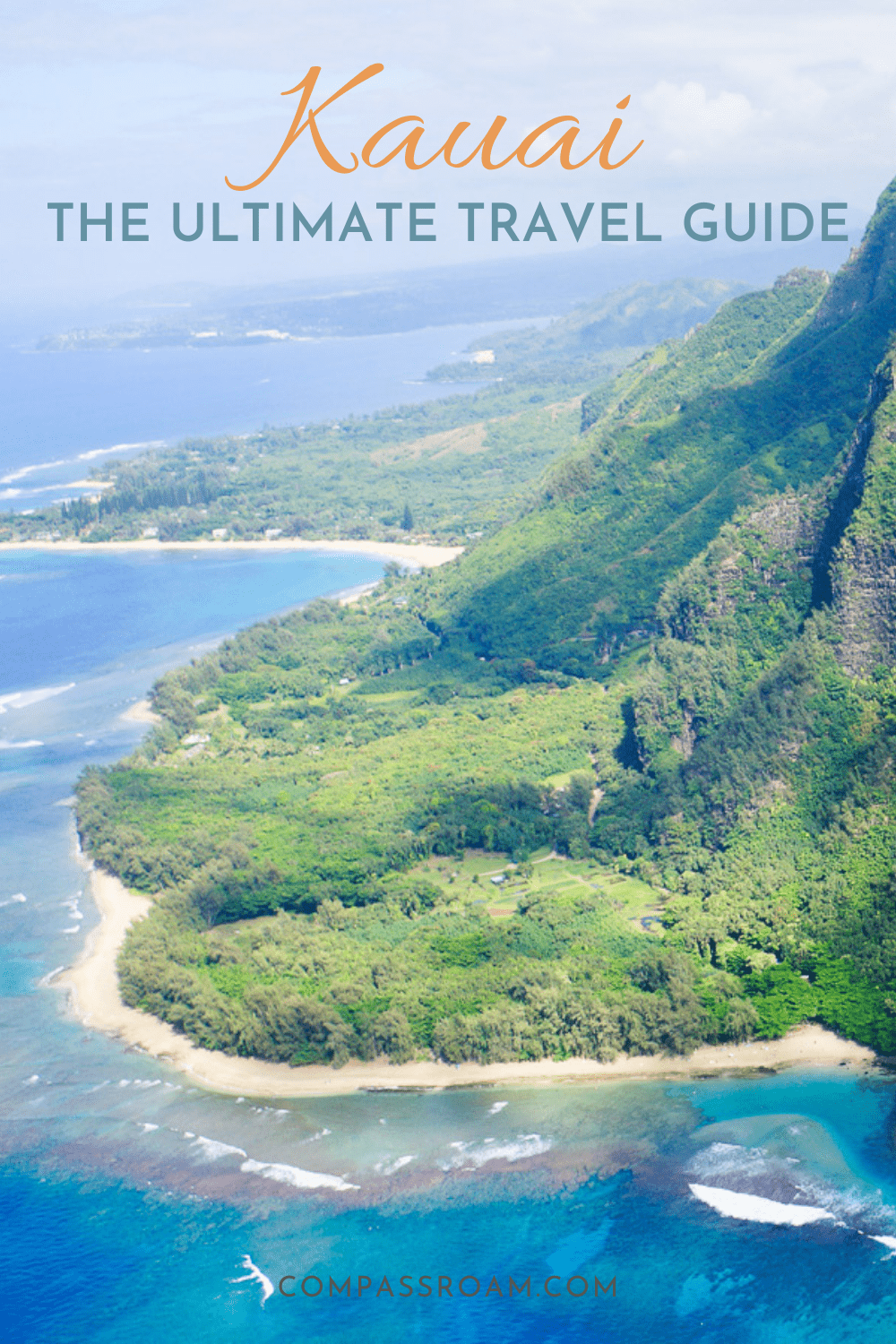

Seriously consider what type of lifestyle you want. Kauai is exquisitely beautiful and most residents prefer spending their days at the beach. Do you like the idea of cleaning your own gutters or mowing your own lawn? would you rather just pay a fee every month and have everything done for you? the answers to these questions can help you narrow down the search for the right type of property for you.

Lastly, it’s time to close. Buyers often do a final walkthrough of the property to see whether it meets their expectations. Understandably, most buyers get too excited and over-eager to close the deal that they sometimes miss certain things in the final walkthrough. Even if the house has already been inspected, it is still best to take note of every detail that you can think of during this step. Things buyers should tick off their checklist are: floors, walls, and ceilings windows and doors trash, clutter, and the previous owners’ belongings to be removed once fully satisfied, the buyer then proceeds to sign the necessary documents to seal the deal.

Setting goals will save you time, money and effort. Is being close to work critically important? or is the neighborhood more important? are you looking for certain schools? or is being closer to shopping more important? defining your goals makes the search less stressful and the path to homeownership clearer. It will also help your locations agent to find homes that fit your needs. This is especially important in a market like hawaii, where inventory is very limited.

Looking to buy a property on kauai? here are five essential tips for making the process as smooth as possible. Get your finances in order. Start by getting a full picture of your credit. Obtain copies of your credit report. Make sure the facts are correct, and fix any problems you find. Next, find a suitable lender and get pre-approved for a loan. This will put you in a better position to make a serious offer when you do find the right house. A pre-qualification letter is a minimum requirement for putting in any offer. A pre-approval is much stronger.

Thousands of homes are for sale in hawaii. But how will you know which house is right for you? clearing your thoughts about what you want in your future home before you go through the possibly emotionally charged process of searching for a home can assist in making a smart decision that you will appreciate for years to come. Home-searching advice: calm your emotions and stick to your rational plan. Be sure the offer is within your budget – with wiggle room. Don’t be afraid to keep searching; other properties may be available that better suit your needs. Overestimating your ability to fix-up the place or downplaying flaws could lead to added financial or emotional stress.